by Ryan Shumaker | Mar 10, 2023 | Blog

We are big fans of the saying, “Give to Caesar his due, but not a dollar more!”, which is why at our firm we focus on helping clients create tax efficient retirement plans and portfolios. With tax filing season upon us, we thought we’d share a few common issues we see...

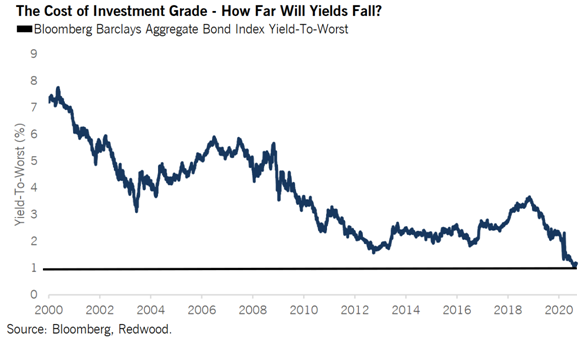

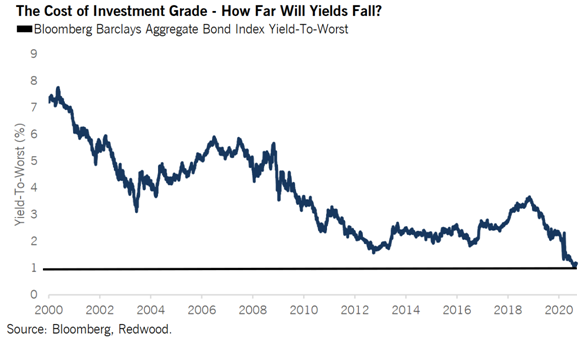

by Ryan Shumaker | Jul 1, 2021 | Blog

Think stocks are high and overpriced? We think the real bubble is brewing in bonds. Looking back to the start of the century, interest rates have been in decline. Back then the Aggregate Bond Index was paying over 7%. Today? Just 1%. This means in order for investors...

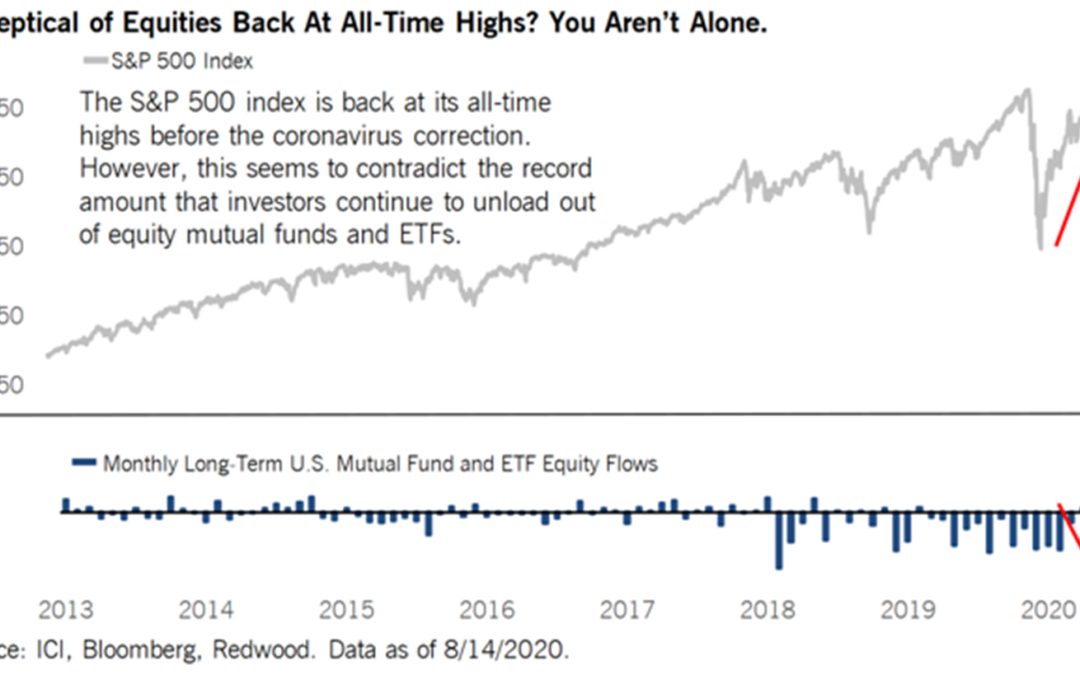

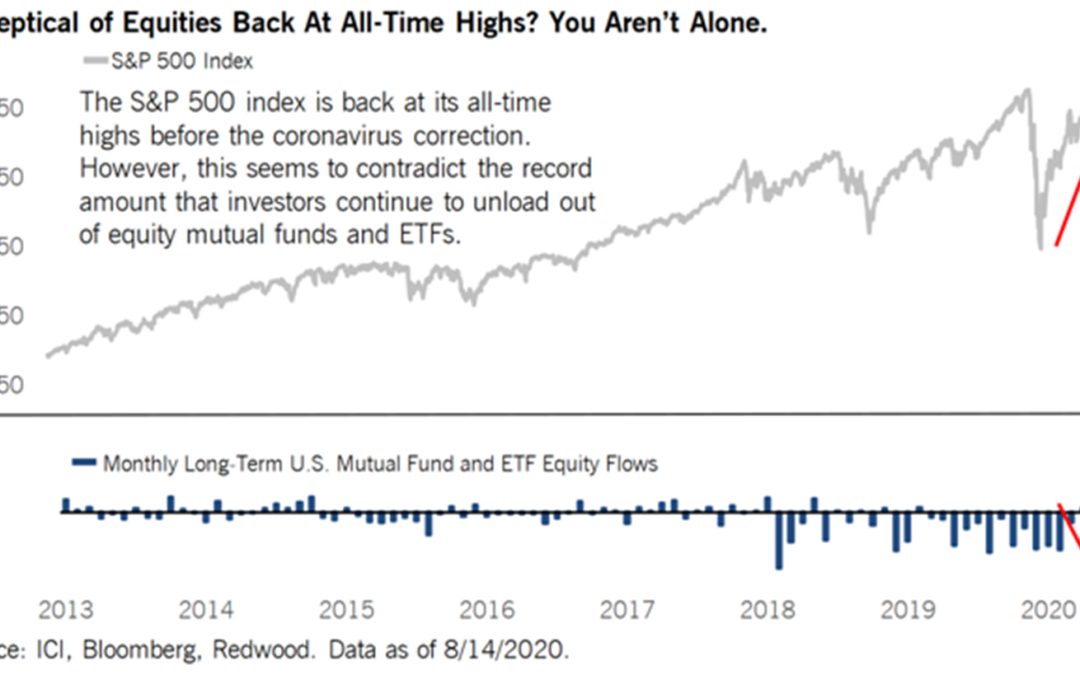

by Ryan Shumaker | Sep 1, 2020 | Blog

Last month the S&P 500 reached a new all time high. Crazily this has come at the same time that retail investors have been piling out of mutual funds and ETFs at a record rate. The week the S&P 500 finally made it back to where it was in February of this year...

by Ryan Shumaker | Mar 10, 2020 | Blog

Financial markets have been on a bit of a wild ride as of late, so we’d like to give some comments and context as to what is occurring. In 12 trading days we have seen the S&P 500 drop by 17% and in just one day we have seen oil drop by more than 30%. On Monday we...

by Ryan Shumaker | Dec 1, 2019 | Blog

Recently, in part one of this article, we discussed how you might be in a lower tax bracket in retirement, but pay a higher tax rate. In this article, we’ll look at how a Roth may be able to help you avoid this scenario. Utilizing a Roth The beauty of a Roth is that...

Recent Comments