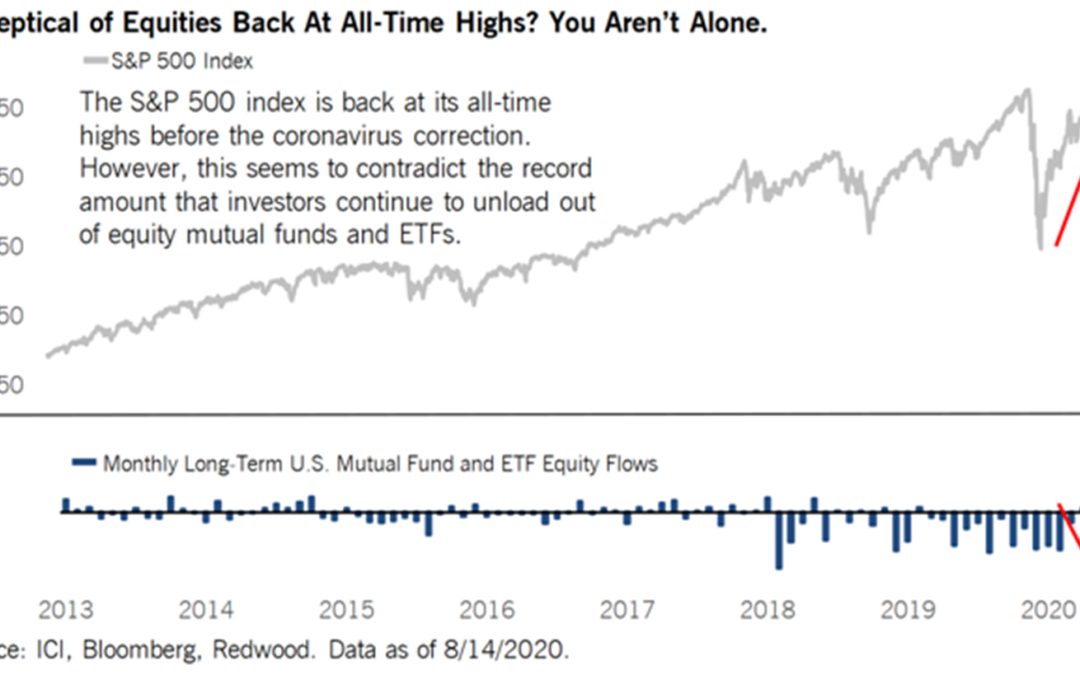

Last month the S&P 500 reached a new all time high. Crazily this has come at the same time that retail investors have been piling out of mutual funds and ETFs at a record rate. The week the S&P 500 finally made it back to where it was in February of this year there was over $20 billion that left these retail investment products. There was actually more that left than this as this is net outflows and also accounts for new money coming back in. It is crazy to believe that in a week where there is so much flowing out of retail investments that the S&P 500 hit a new all time high.

What’s crazier is that this is not new. You can see in the chart that there have been few months where there has been more buying than selling (inflows or positive bars) since the start of 2018 with most months seeing fairly large outflows. Since the start of this trend there has been nearly $500 billion (nearly half a trillion) leave retail mutual funds and ETFs that buy stocks, yet over that time period the S&P 500 is up 33%!

It makes sense why retail investors over the last 2 1/3 years are running for the exits. In the last 2 years we’ve had the 2 largest selloffs in over a decade. Had a magic genie showed up in 2018 and said we’re going to have the 2 largest drops since 2008 and one of them is going to be record breaking in how fast it is you’d probably want to stash everything in a mattress. The problem in doing that is that what you put in your mattress could have grown by nearly 1/3. So, if you had $1 million you decided to stash you would have missed out on $300,000 worth of gains. Not bad especially considering we’ve experienced the worst pandemic in a century during that time.

Just because retail investors are scared and selling, doesn’t mean the market can’t and won’t go up. Retail investors aren’t the only ones investing. In fact, institutional investors like pensions, university endowments, banks, insurance companies, etc. own over 2/3rds of publicly traded stocks. For every winner in the stock market there is an equal and opposite loser. If someone sells a stock and it goes down the person that bought it lost and the person that sold won. The opposite happens if it goes up. Typically that loser is the retail investor and winner an institution. We know this from the data as the S&P 500 has on average made about 50% more per year than the average retail investor, according to Dalbar a company that tracks investor behavior. As much as the average retail investor has underperformed, someone else (mainly institutions) have outperformed.

A shocking 70% of this underperformance in the last 35 years can be attributed to just 10 key periods where investors withdrew their investments during times of market crisis. In only 1 of those 10 periods would an investor have had been better off or had more money a year later if they sold. Market drops, regardless of the reason or quickness, are scary. Losing money stinks there is no doubt about that, but allowing emotion and fear to drive investment decisions and letting panic rule is far and away the most damaging thing you can do.

The key to avoiding this problem is to have a plan. A plan for what you’re going to do not if, but when markets fall. Unless you have a really short retirement, they’re going to fall many times once you’re done working so not planning for that contingency is reckless. Having a plan (especially one that ensures if you’re retired that you’re still going to have the income you desire regardless of what happens with the economy or markets) ahead of time eliminates destructive emotionally driven choices. Thus far this year we have had zero clients sell all of their investments. Zero. Why? Because they have a plan that helps allow them to avoid making emotionally driven decisions.

Material discussed is meant for general/informational purposes and is not intended to be used as the sole basis for any financial decisions, nor be construed as advice to meet your particular needs. Please consult a financial professional for further information.

If living a more worry free retirement is something that interests you, we’re here to help & can be contacted at 785-330-9292.

Recent Comments