Financial markets have been on a bit of a wild ride as of late, so we’d like to give some comments and context as to what is occurring. In 12 trading days we have seen the S&P 500 drop by 17% and in just one day we have seen oil drop by more than 30%. On Monday we saw stock trading halted for losing too much too fast and then on Tuesday we saw trading halted for gaining too much too fast. We’ve also seen interest rates on government bonds in the United States drop to their lowest levels ever recorded. Things are so out of whack right now that the dividend being paid by the average company in the S&P 500 is 6 times HIGHER than the interest a 10 year government bond is paying, something we’ve never come close to seeing before. Heck, a 16 piece meal at KFC now costs more than a 42 gallon barrel of oil!

Source: google.com

You may be asking yourself, given all of these radical events, should I be changing what I am doing?

If you’re already a client of our firm and are in or near retirement, the answer is no. Why? Because events like the last few weeks are something we have already planned for, especially if you need to generate income from your nest egg. Volatility isn’t new, and unless you have a really short retirement it’s not a question of if, but when and how many times you’ll experience it.

According to Standard & Poor’s, the S&P 500 historically sees the following declines in the following frequencies:

-5% or more, 5 times per year

-10% or more, once every 7 months

-15% or more, once every 1.5 years

-20% or more, once every 2.5 years

While the S&P 500 got close to dropping 20% at the end of 2018 it didn’t quite make it that far and it has been since the financial crisis of 2007-2009 we’ve seen it drop that far. In other words, we’ve gone 5 times longer than average since we’ve seen a 20% drop. Does that mean everyone should move everything they have in the market to cash because we are “due?” Absolutely not. Using that logic one would have been sitting in cash the last 8 1/2 years waiting for a 20% drop that is still yet to happen and missing out on a lot of gains along the way. Even if a full 20% drop occurs now the S&P 500 will still be well above where it was 8 1/2 years ago when it would have been “due” for a 20% drop.

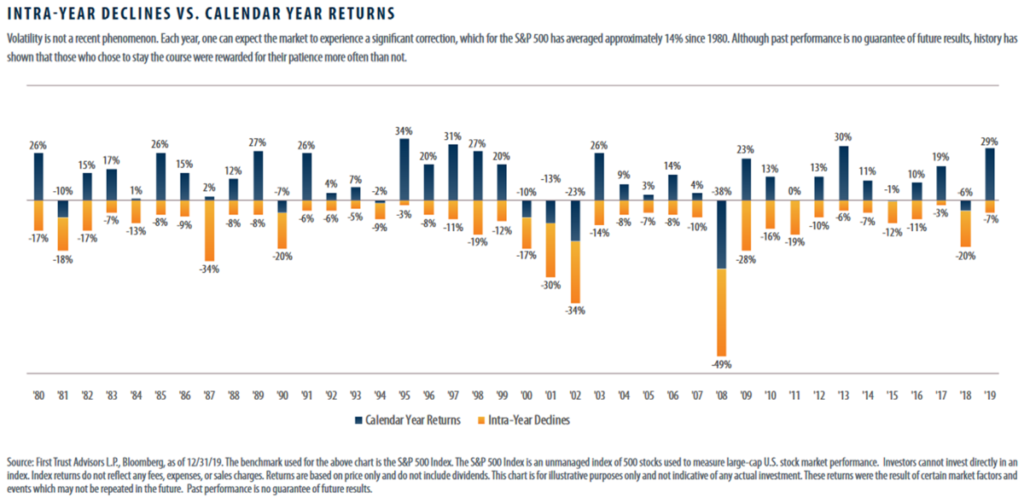

Markets are unpredictable. This is why they offer over the long term much higher returns than investments like CDs that have a predictable guaranteed interest rate. Trying to guess exactly how much or when financial markets may go up or down is a fool’s errand, which is why having a plan in place to deal with volatile conditions is necessary ahead of time. Below is a chart showing the return for every calendar year going back to 1980 in blue. In orange is the amount of loss that was experienced at some point in time during the year.

On average the stock market drops 14% at some point in time during the year. For those of you that are clients and are retired remember we have some of your assets placed somewhere that is either fairly conservative or guaranteed* to not lose value. Keeping a less risky pool of money off to the side allows for taking income when other more growth oriented investments are down. This prevents the dreaded ‘sell low’ and ‘locking in losses’ you’d face if you only, for instance, had stocks as investments and needed income. It also allows for the higher risk / higher return investments the chance to recover from their losses more easily. If you sold those types of investments when they are down to generate income you would be in the unfortunate situation of then having even less money left to recover with making it even harder to get back to even. Planning ahead can help to prevent that.

Having said all of this, for those of you that are having money managed by our firm at either Security Benefit or FolioFN, things have been going quite well. The T Rowe Price Capital Appreciation Fund (which compromise 100% of all accounts at Security Benefit and typically about 50% of most managed taxable investment accounts at FolioFN) really thrives and typically outperforms the most during uncertain markets. Below is a chart comparing its performance (blue) since the last significant drop we saw at the end of the fourth quarter of 2018 versus a combination of the S&P 400, S&P 500, and S&P 600 (orange). We usually like looking at all 3 of these indexes instead of just the S&P 500 for recent history since the S&P 500 is comprised of large US stocks, the S&P 400 medium sized US stocks, and the S&P 600 small US stocks. Looking at just one of the indexes really doesn’t paint a great picture of the entire stock market since it would only include certain sized companies. (note: we’ve talked about only the S&P 500 for longer term market data above since the S&P 400 didn’t begin until 1991 and S&P 600 1994 and have very short histories in comparison)

Chart source: FolioFN Investments. This is not a solicitation to buy or sell any fund or security and past performance is no guarantee of future results. Data as of market close 3/9/20.

You can see how this fund dropped less than half during the last selloff, rallied and had near identical gains on the way back up, and again has experienced far less in the way of losses recently. This is what has led it to outperform by over 27% in less than a year and a half. Again, it thrives during times of uncertainty as that is typically when there is the most opportunity. During calmer markets this type of large outperformance in such a short time period is unlikely for this fund as there is less opportunity. One reason why this fund has thrived during rocky market conditions is its ability to increase or decrease risk and increase or decrease the amount of stocks owned at any given time. As of the start of this month the fund only holds roughly 53% of its assets in stocks and at anytime can vary that percentage from 50%-100% as market conditions change. It varies the amount of stock ownership in order to help accomplish its stated goal of making up all losses within 3 years. Although there is no guarantee it achieves this goal moving forward, it has been able to successfully do it going all the way back to when it began in 1986. Unless you need money from this fund in the next 3 years, then there should be very little to worry about what you may have invested in it. For those of you that are clients needing to generate income now that own this fund, you should have other investments that we can draw from in the unlikely event this fund needs several years to recover either during this downturn or any future downturn.

So what about those of you that have FolioFN accounts that are in other investments besides this fund? Well there’s no easy or practical way to chart performance of all accounts we manage there and aggregate them all together. I can say that our more conservative income strategies at FolioFN actually have many holdings that are actually up and have gained so far this year, which have really helped balance out and damper any losses in the growth strategies. On the growth side of things, the single largest holding in the growth strategy we are managing is a ‘buffered ETF’ with the ticker FNOV (again this is not a solicitation to buy or sell this or any security). Essentially how this investment works is if we hold it until November 1st, the first 10% of any losses (before investment expenses) in the S&P 500 from November 1st of last year to November 1st of this year will be ‘buffered out.’ What that means is that if the S&P 500 were to stay down between 0%-10% until November 1st this investment will experience zero losses. Only the losses greater than 10% should be experienced. The trade off for this is that the most it can make is 12.36%. Given that as of market close Monday the S&P 500 was down 12.05% since last November 1st, this means that we still have the ability to capture all gains up to 24.41% that the S&P 500 has between now and this November 1st. It also means that if the S&P 500 were to stay exactly where it is at now between now and then we will only experience losses of 2.05% instead of 12.05%. To read more about this ETF you can visit First Trust’s website here First Trust Buffered ETFs

The only thing certain about the stock market or any other higher risk and higher returning asset is that it is uncertain. Having said that, the current decline has been fast and sharp and historically looking back to other fast and sharp declines the recovery is also typically fast and sharp too. Usually its steady and long declines that then finally end in fast and sharp declines like that in 2000-2003 and 2007-2009 that should worry investors. Current market conditions are more like what we saw at the end of 2018, or the flash crash of 2010 (where the stock market dropped about 9% in less than a few minutes, but ended the year with a 13% gain), or ‘Black Monday’ in 1987 (where in a single day S&P 500 futures contracts lost 29%, but ended the year with a 2% gain.)

The bottom line here is there are always reasons for the markets to go down and they regularly do. Over the last few years we’ve had the Greek debt scare, Brexit, Chinese tariffs, and most recently the Coronavirus and oil price war. In fact, 95% of trading days the stock market is below its all time high, meaning that 95% of the time a stock portfolio would have at some point in time in the past been worth more than it is today. Only 5% of trading days the market reaches an all time high, but over time has rewarded investors with healthy gains in exchange for the risk taken. Trying to jump out of the market on one of those 5% of trading days where it’s at an all time high and then jump back in at a low before it rallies back and starts making new all time highs again is impossible to do consistently over time. This is why having a strong financial plan and portfolio strategy in place designed to have contingencies for long or lengthy market drops is so important.

As I said at the beginning, it isn’t a matter of if, but when and how many times the stock market will drop during someone’s retirement, unless it’s a very short one. Failing to plan for those events is essentially planning to fail.

If you’re not yet a client and would be interested in having our firm assist you in possibly putting a plan in place for your personal situation to help relieve any worry or panic during volatile times you can schedule a 3 step review by calling us at 785-330-9292.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. The information herein has been derived from sources believed to be accurate. Please note ‐ investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. There are no guarantees associated with any forecast and the opinions stated here could be wrong due to false signals from the models, or the models being incorrectly structured, incorrectly updated and/or incorrectly interpreted. The signals and forecasts only express our opinion of various securities and/or economic date. Our opinion will be wrong at times because of the limitations of investment analysis. Investment analysis, whether fundamental, technical or any other form of investment analysis, cannot predict the future and is not a science that predicts precise and accurate results. Your use of any information from our models is at your own risk and without recourse.

Recent Comments