When it comes to investing, for every loser there is an equal and opposite winner. If someone sells something to someone else and it goes up in value the person that sold lost while the person that bought won (and vice versa). According to Dalbar’s most recent study titled “Quantitative Analysis of Investor Behavior,” the average retail investor has made less than half the return of the stock market over the last 30 years. In fact, the average investor has made less per year investing than the over 3% that inflation has averaged in the United States since the US Bureau of Labor Statistics started tracking in 1913. So if the average investor is losing, who is winning and why?

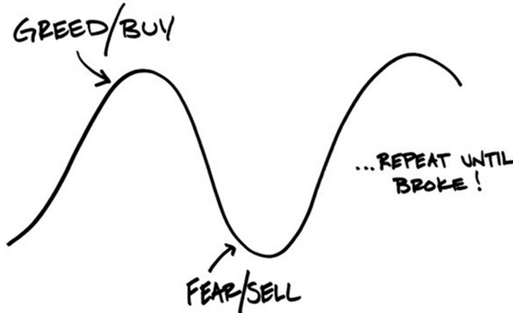

First, let’s talk about the why. The overwhelming reason, accounting for over 70% of the underperformance, is investor behavior during times of market volatility. The reality of the situation is that while investors should ‘buy low and sell high’ people are emotionally compelled to ‘buy high and sell low.’ As pointed out in one of our previous articles, the last large selloff sparked by Covid-19 resulted in 1/3 of those 65+ years old (which would be those not only in or near retirement, but also typically those with the largest balances) selling 100% of their investments at or near the market bottom. Time and time again, when you look at retail mutual funds you’ll see big inflows when things are high and big outflows when things are low. Far too many retail investors rely on emotion- particularly greed and fear. People like to hop on board with ‘what’s hot’ right now, which generally means after the value has already increased (crypto the last few years, real estate in 2007, tulip bulbs in 1634, etc.) and then panic sell after steep drops. People see others getting rich and want to get rich too (greed) and those are the people that usually are left holding the bag when the bubble inevitably bursts and panic selling occurs (fear).

Generally speaking, it’s not wise to own or buy ‘what’s hot’ right now as most, or possibly all, the gains have likely already happened. The ‘smart money’ being managed by institutions usually takes advantage of the emotional decisions of retail investors by ‘buying low’ from them when individuals are panic selling and ‘selling high’ when individuals are overrun with greed and panic buying. In the flagship portfolio our firm utilizes, we like to buy into ownership of good, well-run companies where there is some sort of temporary issue or short term negative news, but still a terrific long term outlook. We’re not trying to buy, for instance, companies that have both short term and long term issues (think wagon wheel or buggy whip makers in days past). Medical device companies would be a great recent example of those with a short term issue, but great long term outlook. With Covid, elective procedures (many of which utilize medical devices like a knee replacement) were banned in much of the country for a time and certainly were down even after restrictions eased due to other factors such as staffing shortages. As a result, many medical device companies saw sales and profits plummet, which caused people to panic sell these companies. Keep in mind that long term if you need something like a knee replacement, you will still need it! So, in the short term these companies were not doing well, but over the long term their business will not only return to what it was, but become even larger and better as all of the backed up procedures that were put off are done in addition to normal business.

In our flagship growth portfolio we also focus on managing money so that, in a worst case scenario, accounts are worth the same 3 years from now as they are today (with there being many, many scenarios better than the worst case). And if there are any losses, we want them totally eliminated in less than that time frame. With this approach our clients don’t have to worry about what is going on with the economy, elections (which happen every 2 years), global wars (there has been a major global conflict or war on average every 2.72 years over the last 90), or any other major negative news making headlines. If we put 3 years worth of desired income into some sort of conservative investments, then a client can draw from them the income they want and need and by the time they’re used up the rest should be recovered eliminating ever having to ‘sell low’ to generate income or because of worry. We find that usually our greatest outperformance occurs when markets are uncertain and volatile, like they have been lately, as that is when there is the most opportunity to take advantage of others making foolish moves based on emotions.

If you’re worried about current events it likely means you don’t have a plan or have a bad one. Relying on emotion not only creates a lot of stress and anxiety, but also usually leads to poor results. A good, solid plan and approach can eliminate this possibility and cause one to actually excel, outperform, and profit when markets are becoming rocky by taking advantage of those who don’t have a plan and are panicking.

If you’d like help creating a plan with an investment advisor with experience working in Topeka and Lawrence, just fill out the form below or give us a call at 785-330-9292.

Recent Comments