by Ryan Shumaker | Jan 13, 2023 | Blog

Beneficiary designations are important in determining where certain assets of an estate will end up. Many think that a will or trust is what determines where everything goes. This is not necessarily true, and it’s a big mistake to make this assumption. A last will and...

by Ryan Shumaker | Nov 18, 2022 | Blog

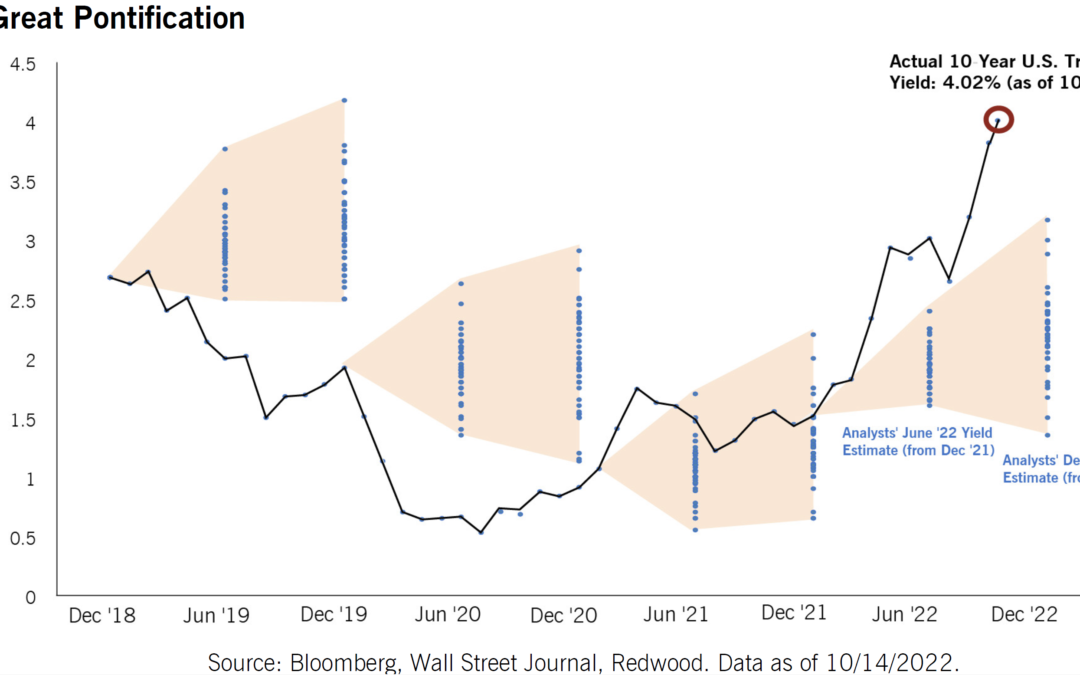

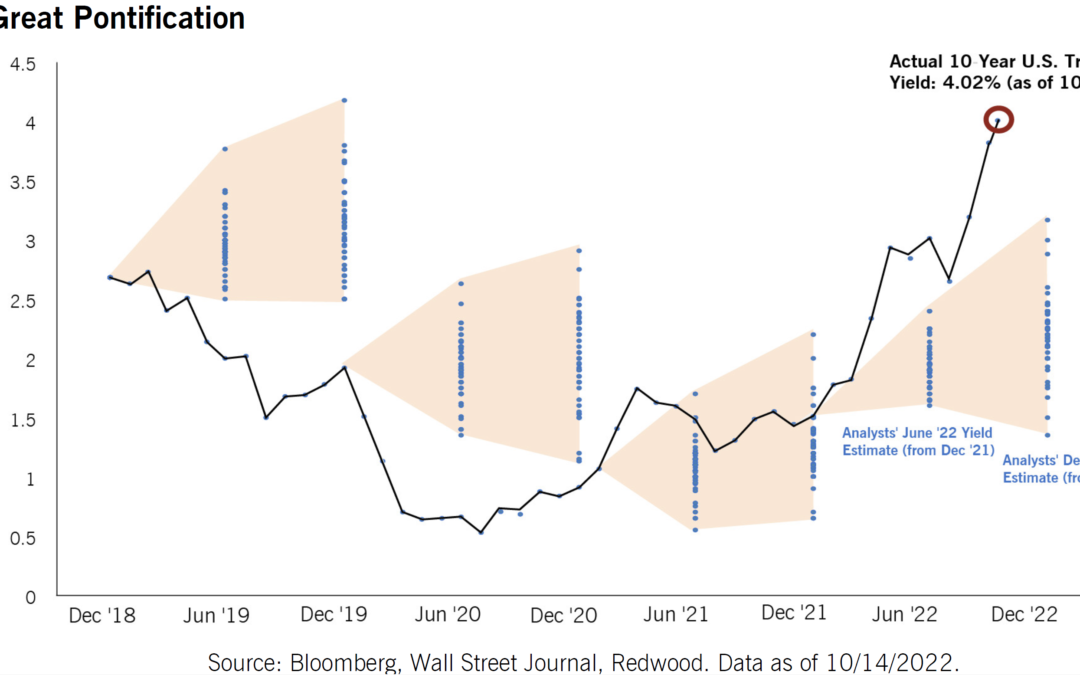

Gas prices, grocery store bills, and interest rates have all been rising at a fairly high rate recently. It seems to be what everyone is talking about. The question is, where are they headed next? To be blunt and to the point, no one knows and listening to those that...

by Ryan Shumaker | Sep 16, 2022 | Blog

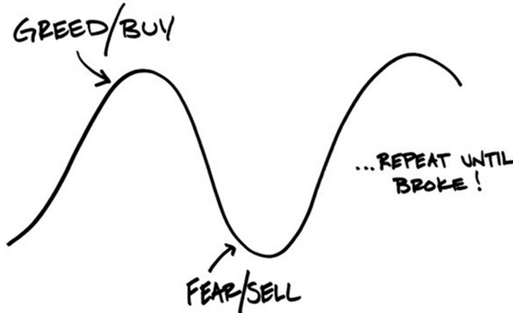

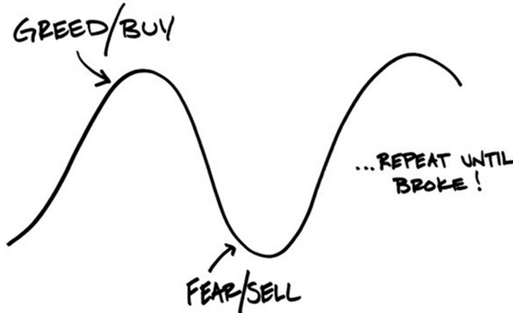

When it comes to investing, for every loser there is an equal and opposite winner. If someone sells something to someone else and it goes up in value the person that sold lost while the person that bought won (and vice versa). According to Dalbar’s most recent study...

by Ryan Shumaker | Aug 16, 2022 | Blog

You probably read or hear about some “Top Ten” list nearly every day, but take a moment to read this one. This list is different, and probably not the kind of list you’d expect a financial advisor to write. Reason #10: “It’s too expensive” Being penny wise and dollar...

by Ryan Shumaker | Jul 7, 2022 | Blog

Interest rates have been soaring and bonds, typically seen as a more conservative or ‘safer’ investment, are seeing their largest loss in history as a result. In fact, if you look at the US Aggregate Bond Index (this is the most widely followed bond index and the...

Recent Comments